PCI DSS, or Payment Card Industry Data Security Standard, can be a confusing set of guidelines for Indian businesses covering customer data and avoiding compliance meltdowns. The reality is, compliance was never meant to be a check. It's about protecting your business, your brand, your customer, and is a necessity for staying nimble in an ever-changing digital world.

But the burning question for every business owner and tech lead is, "How much will PCI DSS compliance cost me?" And here's the spoiler alert. There will never be a definitive answer to this question. But by the time this post is done, you will have enough information to make informed decisions about your business and even save some rupees in the process.

PCI DSS Scope & Cost Estimator

Share your transaction level and architecture for a tailored cost range and timeline.

Unpacking PCI DSS: It's More Than a Regulation

Imagine you own a little bakery in Bangalore or lead a thriving fintech team in Mumbai. If you handle even a single card transaction, the PCI DSS guidelines are staring right at you. These global standards set by the top card networks—Visa, MasterCard, you name it—are non-negotiable for protecting cardholder data.

You might be tempted to shrug it off, thinking, "I'm too small" or "Hackers won't target my business." The reality? Security gaps don't discriminate. A single slip-up could mean losing your customers' trust, hefty fines, or sleepless nights over data breach headlines.

So, What Actually Affects PCI DSS Costs in India?

Let’s be upfront: the range of PCI DSS costs in India is wide—think low cafe budget to enterprise IT spend. Why? Because every business's journey is unique. Here's what shapes it:

-

Your Company's Size & How Tangled Your Tech Is

The bigger or more complex your operation, the deeper you'll need to dig into your pockets. More transaction points, more databases, more people, and each factor adds layers (and cost) to your PCI DSS journey. For a cozy e-commerce startup, the costs may be manageable. For a nationwide retailer? Expect a bill with more digits.

-

Your "Compliance Level" And It Matters More Than You Think

PCI DSS isn't a flat rulebook. It divides businesses into four levels based on yearly card transaction volume:

- Level 1: 6 million+ transactions (think Amazon-scale)

- Level 2: 1–6 million transactions

- Level 3: 20,000–1 million transactions

- Level 4: Less than 20,000 transactions

Your level dictates the depth of the audit you'll need. Knowing your level first avoids unnecessary surprises down the track.

-

Audit and Consulting Fees (The "Expert Eyes" Factor)

You're probably going to need a QSA (Qualified Security Assessor), the people accredited by the PCI Council to find holes in your Security and get you compliant.

Not everyone thinks about consulting someone to do a gap analysis, or an implementation roadmap, but they are like a guide in a twisted overgrown forest; you will move quicker, and save you mistakes that could end up costing you a lot.

-

Technology Upgrades: Where the Rubber Meets the Road

Thinking of skipping upgrades? Think again. PCI DSS usually requires modern firewalls, encryption everywhere, solid endpoint controls, and real-time monitoring. Each tech piece is like insurance—it costs upfront, but pays off by keeping disaster at bay.

Pro tip: Don't just chase shiny new tools. Evaluate what fits, what scales, and what sets you up for easy audits next year.

-

Empowering Your People (Training Isn't Optional)

Too many breaches start with a simple mistake—an employee clicking the wrong link or mishandling data. Good training saves money and headaches. Build security awareness into your culture as much as your code.

-

Staying Compliant = Ongoing Investment

You can't just buy a certificate and forget about it. PCI DSS compliance comes with annual reviews, renewals, and evolving requirements.

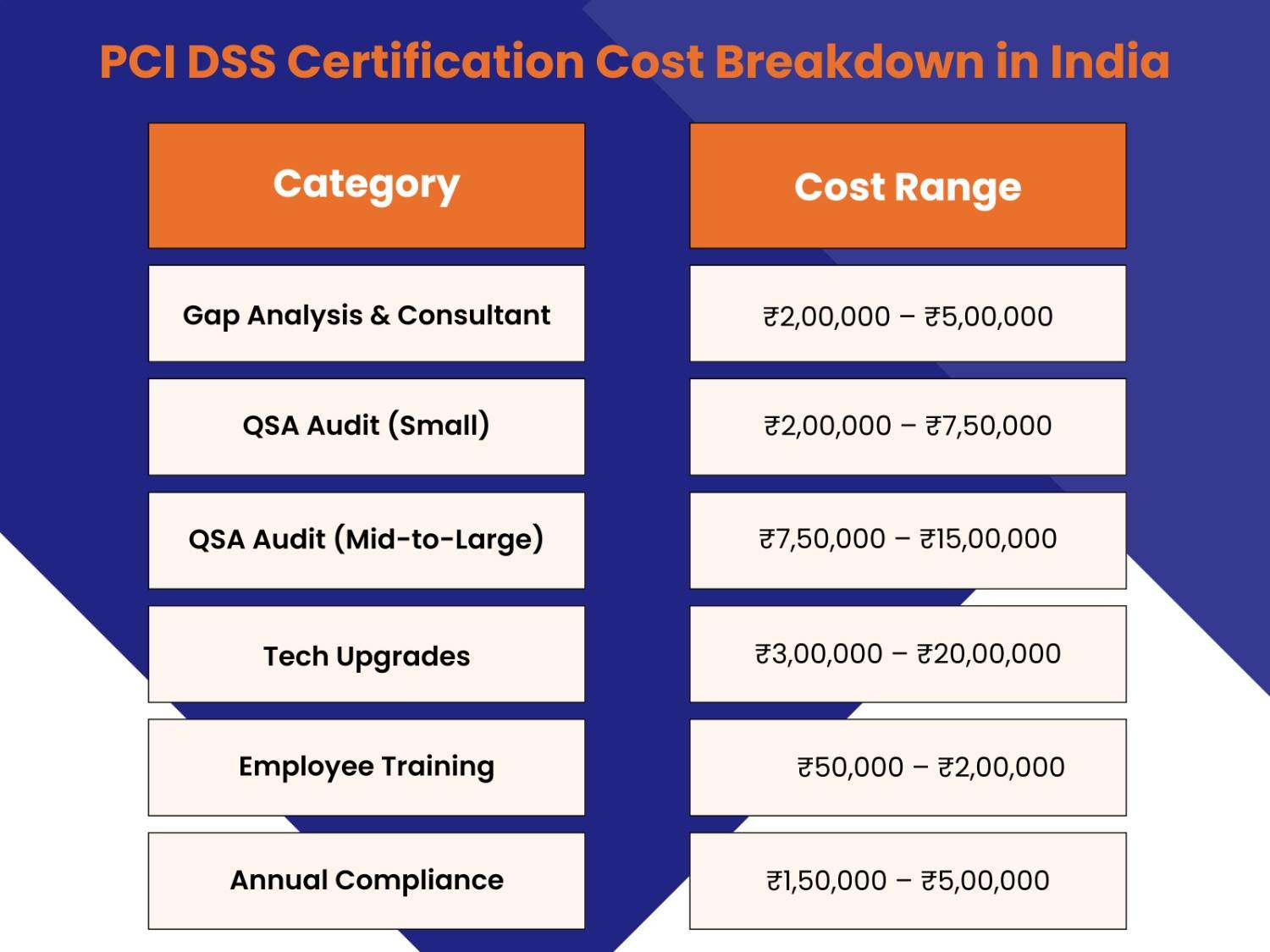

The Numbers: PCI DSS Certification Cost Breakdown in India

You came for the figures. Here's what you might realistically expect to spend on your PCI DSS journey:

Keep in mind, these are approximate numbers. Your "real" costs may vary depending on your business.

Pre-Audit Gap Review

Identify quick wins, trim QSA hours, and sequence upgrades to fit your budget.

Five Smart Ways to Slim Down Your PCI DSS Spend

Feeling like compliance costs are a bottomless pit? Don't worry— smart business owners carve out savings without risking Security. Here's how:

-

Run an Internal Checkup First

Before parading in the QSA, do a dry run. Patch visible holes, tighten the protocols, and document everything—it'll save time (and audit hours).

Pick Scalable Security Tech: opt for cloud-based or modular tools that can grow with you.

-

Lean on PCI-Compliant Vendors

Using third-party processors or managed security services helps offload responsibility (and costs).

-

Prioritize High-Risk Areas

Tackle areas most exposed to card data first. You'll achieve compliance faster and can tackle the long tail of controls next quarter.

-

Make Security Training a Habit

One engaged, knowledgeable employee can prevent a breach that would cost you lakhs to fix.

What Trips Up Indian Businesses on the PCI DSS Path?

India's business environment isn't a photocopy of the West, and local entrepreneurs face specific hurdles:

- Lack of Awareness: Many smaller businesses don't realize just how critical (and mandatory) PCI DSS is until something goes wrong.

- Outdated Tech: Running on legacy systems? Compliance costs skyrocket when you start enhancing old systems with new technology.

- Risky Gap Periods: As you migrate to compliance, watch out—bad actors pounce during transitions. Don't drop your guard.

- Choosing the Wrong Partners: A consultant who disappears or a QSA who rushes the job can cost you double. Invest in expertise, not just price.

Why PCI DSS is an investment, not a Drain

Here's the truth: PCI DSS doesn't just guard you from fines. It delivers outsized returns, including:

- Real Data Security: Safe customers mean fewer headaches (and no embarrassing breach notifications).

- Trust That Drives Sales: Customers flock to brands they believe will protect them. Displaying PCI DSS compliance is a huge trust signal.

- No-Surprise Audits: Once you're compliant, "surprise" checks or regulatory scrutiny are far less scary.

- Smoother Operations: A side effect most don't count on—processes get sharper as you chase compliance.

The Takeaway: Don't Just Comply, Get Ahead

Getting PCI DSS compliant is like future-proofing your business. Getting started early, upskilling your people, investing in the right places, and a combination of honesty and creativity in your budgeting are all important contributors to a long-term ROI.

Consider compliance as your opportunity to go beyond simple survival and actually thrive. If you're unsure or are staring blankly at your budget spreadsheet, hear this: PCI DSS compliance could be achieved easily with the right plan and partners.

FAQs

-

How much does PCI DSS compliance cost for small businesses in India?

If you're running a small business in India, how much PCI DSS compliance will set you back? On average, you're looking at anywhere between ₹2,00,000 to ₹7,50,000. This covers things like hiring a QSA for audits, upgrading your tech, and training your team. The good news? You can save a lot by doing a bit of prep work yourself, like running internal checks and using PCI-compliant vendors.

-

What are some practical ways to save on PCI DSS compliance costs?

Let's face it—compliance can feel expensive. But there are smart ways to keep costs in check without cutting corners. Start by doing an internal review before bringing in a QSA; it'll save you time and money. Invest in cloud-based tools that can grow with your business, and work with PCI-compliant vendors to share the load. Focus on securing the riskiest areas first, and don't forget to train your team—one well-trained employee can prevent a costly mistake.

-

Why should Indian businesses care about PCI DSS compliance?

If you're handling card payments, PCI DSS compliance isn't just a box to tick—it's a way to protect your business and your customers. It helps you avoid data breaches, build trust with your customers, and even streamline your operations. Plus, being compliant means you're less likely to face surprise audits or fines. Think of it as an investment in your business's future, not just another expense.

Make PCI DSS predictable—every year

We’ll right-size scope, trim audit time, and sequence upgrades for a clean, defensible pass.

Talk to CyberCube