UPI has completely changed the way India pays. Originally intended to be a simple method of sending money between individuals, it has developed into one of the biggest real-time digital payment systems globally.

Billions of monthly transactions are conducted via UPI for both small street vendors and large enterprises; therefore, depend entirely on this platform.

As with any ecosystem at this scale, there is increased risk associated with operating within the ecosystem. Security and safety are not optional as UPI becomes increasingly present in day-to-day life.

This is where the NPCI UPI Audit comes into play.

The National Payments Corporation of India (NPCI) enables the UPI platform to function, and is also responsible for ensuring that organizations participating in the ecosystem operate according to established operational and security policies and standards.

The NPCI UPI Audit is not only a regulatory requirement; it also provides participants with a safety net against fraud, protects ecosystem users, and strengthens India’s electronic payments ecosystem.

Need UPI Audit Readiness Support?

We help validate controls, documentation, and technical security across UPI integrations.

Why NPCI UPI Audit Exists

UPI is not a single system—it is a network of multiple players working together in real time. This includes:

- NPCI as the central authority and transaction switch

- Issuer and acquirer banks

- PSP (Payment Service Provider) banks

- TPAPs (Third-Party App Providers like Google Pay, PhonePe, etc.)

- Payment intermediaries and fintech companies

- Merchants and service providers

Because so many entities are involved, even a small security gap at one point can create major risks across the ecosystem. Some of these risks include:

- Financial fraud

- Data breaches

- Failed or delayed transactions

- System outages

- Loss of customer trust

The NPCI UPI Audit framework exists to reduce these risks by ensuring every participant follows a consistent and robust security standard. This is not a one-time checklist exercise—it is a continuous process of security assurance.

What is NPCI UPI Audit?

An NPCI UPI audit provides structured examinations at technical, security, and operations levels to evaluate whether organizations integrating with UPI comply with NPCI’s technical, security, and operational guidelines.

Overall, it ensures a compliant, secure, and safe environment for UPI participants conducting transactions.

The audit typically covers:

- Review of UPI API integrations

- Security testing of applications and backend systems

- Validation of encryption and key management practices

- Assessment of fraud prevention controls

- Evaluation of data privacy and governance policies

- Review of incident response and monitoring systems

- Alignment with NPCI circulars and operational guidelines

These audits are usually carried out by independent security experts who specialize in payment security and financial systems.

How UPI Works (Security Context)

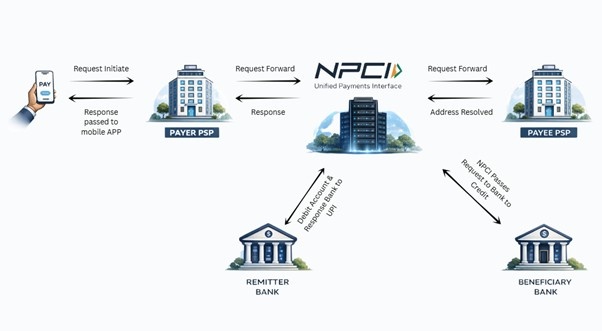

To understand why security is so important, consider a UPI transaction at a high level:

- A user initiates a payment from a UPI app.

- The app securely communicates with its PSP bank through APIs.

- The PSP forwards the request to NPCI’s UPI switch.

- NPCI validates the transaction and routes it to the relevant banks.

- The payer’s bank debits the amount and the payee’s bank credits it instantly.

- A confirmation message is sent back to the user.

At every step, strong security controls must be in place to prevent unauthorized access, data leaks, or transaction tampering. This end-to-end journey is a key focus area during an NPCI UPI Audit.

Key Focus Areas of an NPCI UPI Audit

1. UPI API Security

APIs are the backbone of UPI. They allow apps, banks, and NPCI systems to communicate in real time. However, poorly secured APIs can become easy entry points for attackers.

During an audit, assessors check whether organizations have:

- Strong authentication mechanisms

- Proper validation of API requests

- Protection against common API vulnerabilities

- Rate limits to prevent abuse

- Clear access controls and user roles

- Secure handling of transaction data

The goal is simple: ensure APIs are designed and implemented securely.

2. Encryption and Key Management

UPI transactions involve highly sensitive data, such as:

- Virtual Payment Addresses (VPAs)

- Bank account details

- Transaction information

- Device identifiers

NPCI expects organizations to:

- Encrypt data in transit and at rest

- Store cryptographic keys securely (preferably in HSMs)

- Rotate encryption keys regularly

- Restrict access to sensitive security materials

Auditors do not just check policies—they verify real implementations.

3. Secure Device Binding

One of UPI’s core security principles is device binding. This means:

- A UPI account should be linked to a specific device

- Unauthorized devices should not be able to access the account

- Suspicious device behavior should trigger additional verification

During the audit, organizations must prove their apps properly enforce secure device identification.

4. Fraud Detection and Risk Monitoring

UPI fraud is evolving, and so must security defenses. NPCI expects organizations to have:

- Real-time fraud detection systems

- Behavioral analytics to spot unusual activity

- Velocity checks to detect abnormal transaction patterns

- Risk scoring for high-risk payments

- Automated alerts for suspicious behavior

Auditors assess whether these systems are actively working—not just documented on paper.

5. Data Privacy and Governance

NPCI strongly emphasizes responsible use of customer data. This includes:

- Collecting only what is necessary

- Using data strictly for payment purposes

- Avoiding unauthorized data sharing

- Maintaining clear data retention policies

Organizations must demonstrate strong data governance during the audit.

6. Logging, Monitoring, and Incident Response

Security is not just about preventing attacks—it is also about detecting and responding to them.

An NPCI UPI Audit checks whether organizations have:

- Comprehensive security logs

- Real-time monitoring of transactions and systems

- Clear incident response procedures

- Defined escalation paths for security incidents

- Coordination plans with NPCI in case of major breaches

If an organization is not prepared for security incidents, it raises serious concerns.

Strengthen Your UPI Security Posture

We help you validate controls across APIs, encryption, fraud monitoring, and IR readiness.

Who Needs to Undergo NPCI UPI Audit?

Typically, these entities fall under NPCI UPI Audit requirements:

- PSP banks

- Third-Party App Providers (TPAPs)

- Payment aggregators and processors

- Fintech companies integrating UPI APIs

- Large merchants handling high transaction volumes

The exact audit frequency depends on NPCI’s guidelines and the organization’s risk level.

Common Challenges Organizations Face

Many organizations struggle with NPCI UPI Audit because of:

- Poor documentation

- Weak API security

- Improper encryption practices

- Lack of structured fraud monitoring

- Inadequate incident response planning

Treating the audit as just a checkbox exercise often leads to negative findings.

How Organizations Should Prepare for NPCI UPI Audit

To make the audit smoother and more effective, organizations should:

- Conduct internal security reviews in advance

- Validate all UPI API integrations

- Strengthen encryption and key management

- Improve fraud detection systems

- Keep security documentation updated

- Perform regular penetration testing

- Align internal processes with NPCI guidelines

A proactive approach always works better than last-minute preparation.

Business Impact of Strong UPI Security

Investing in UPI security is not just about compliance—it makes good business sense. It helps:

- Build customer trust

- Reduce fraud-related financial losses

- Strengthen brand reputation

- Ensure uninterrupted service

- Minimize regulatory risks

A secure UPI ecosystem benefits both businesses and users.

UPI Audit as a Pillar of Digital Trust

The NPCI UPI Audit is a central component for protecting India’s digital payment ecosystem.

The audit protects users’ assets (security) and their private information (privacy) to maintain consumer protection, enhance innovation with fintech companies, and allow for consumer choice.

To ensure UPI is used safely and reliably, organizations must treat security as a continuous process—not solely the result of an annual audit.

The value of a strong UPI security posture is not only the outcome of receiving a passing audit, but also providing users with assurance that confidential information is protected as millions of users use UPI daily.

Frequently Asked Questions

1. Who needs to undergo NPCI UPI Audit?

PSP banks, TPAPs, payment aggregators, fintech platforms, and large merchants handling UPI transactions typically require NPCI UPI Audit.

2. How often is NPCI UPI Audit conducted?

The frequency depends on NPCI directives, organizational risk profile, and transaction volume, but audits are generally conducted periodically.

3. Why is NPCI UPI Audit important?

It helps prevent fraud, protects user data, secures payment APIs, and ensures the resilience of India’s digital payments ecosystem.

Strengthen UPI Security & Audit Readiness

Get a practical readiness plan across API security, encryption/key management, fraud controls, monitoring, and incident response aligned to NPCI expectations.

Talk to CyberCube